SQream Secures $45M Funding to Enhance Its GPU-Powered Big Data Analytics Platform

Most people like

Introducing an AI tool designed for effortlessly crafting impactful landing pages in no time. Streamline your design process and boost conversion rates with this innovative solution tailored for marketers and businesses alike.

In today's fast-paced digital landscape, customer service agents play a crucial role in driving customer satisfaction. However, navigating complex queries can be challenging without immediate support. Our Real-Time Guidance Platform empowers contact centers by providing agents with instant, context-sensitive assistance, ensuring they deliver accurate and timely responses. By leveraging advanced analytics and AI-driven insights, this platform enhances agent performance, optimizes customer interactions, and ultimately boosts overall productivity in your contact center. Experience the future of customer service today!

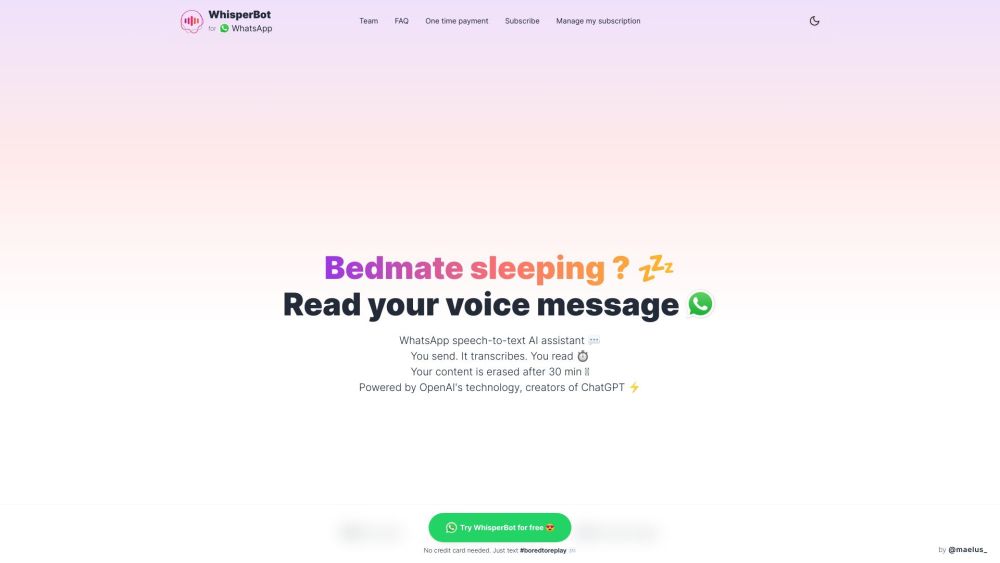

Introducing WhisperBot, your intelligent AI assistant for WhatsApp that seamlessly transforms voice messages into accurate text transcriptions. Experience the convenience of easily reading messages instead of listening to them, all with the power of cutting-edge AI technology.

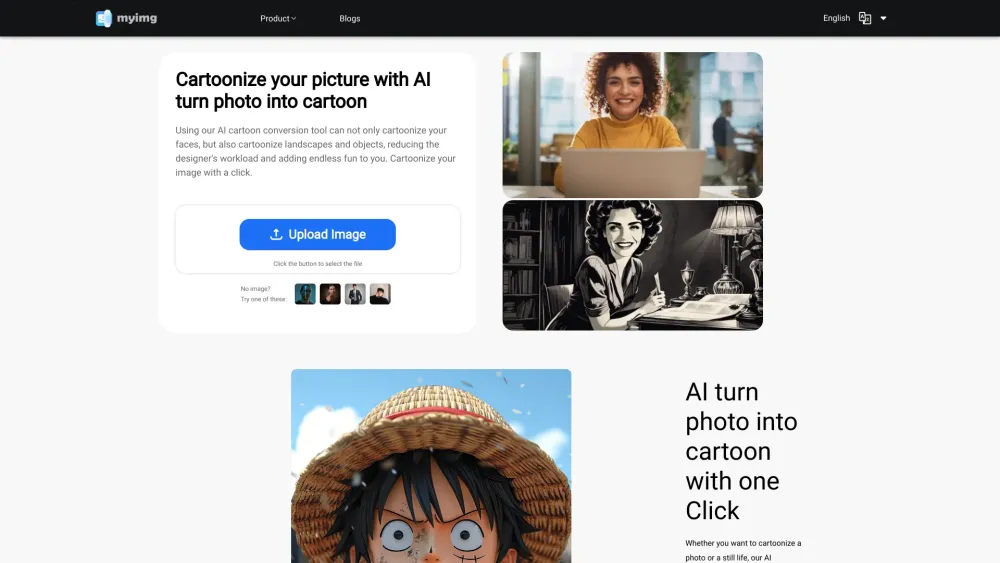

Transform Your Images and Videos into Stunning Cartoons Instantly

Unleash your creativity by effortlessly converting your photos and videos into captivating cartoon versions. This tool allows you to cartoonize images and videos in just a few clicks, providing a fun and unique way to express your artistic vision. Whether you're looking to create eye-catching content for social media, personalize gifts, or simply explore your creative side, discover how easy it is to instantly cartoonize your visuals today!

Find AI tools in YBX

Related Articles

Refresh Articles