Surging Investment in AI Companies: Middle East Capital Emerges as a Key Player

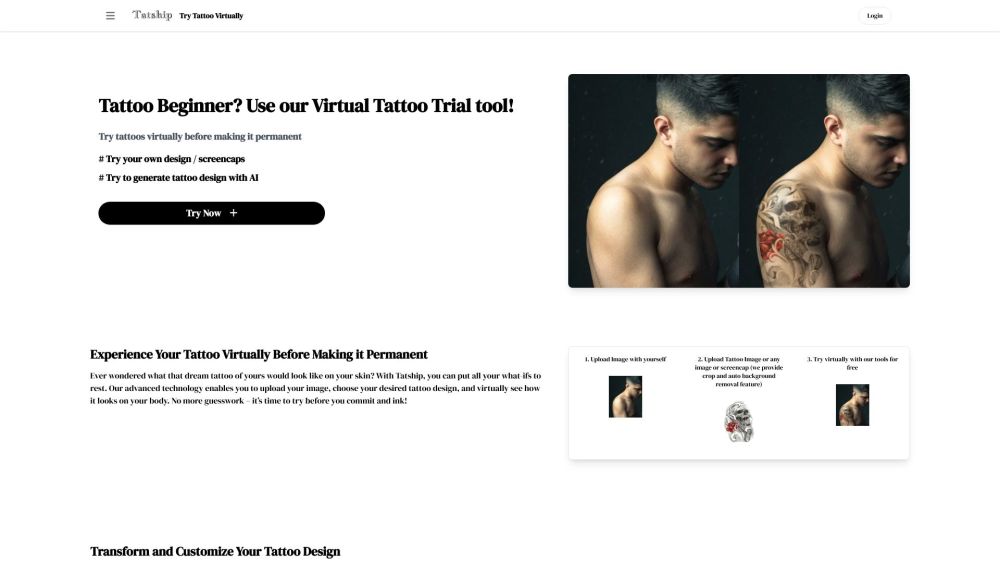

Most people like

Welcome to NSFWChatAI.ai, the ultimate AI virtual girlfriend chatbot platform, where you can engage in unrestricted conversations with your virtual companion. Experience the freedom of chatting without limits in a safe and interactive environment!

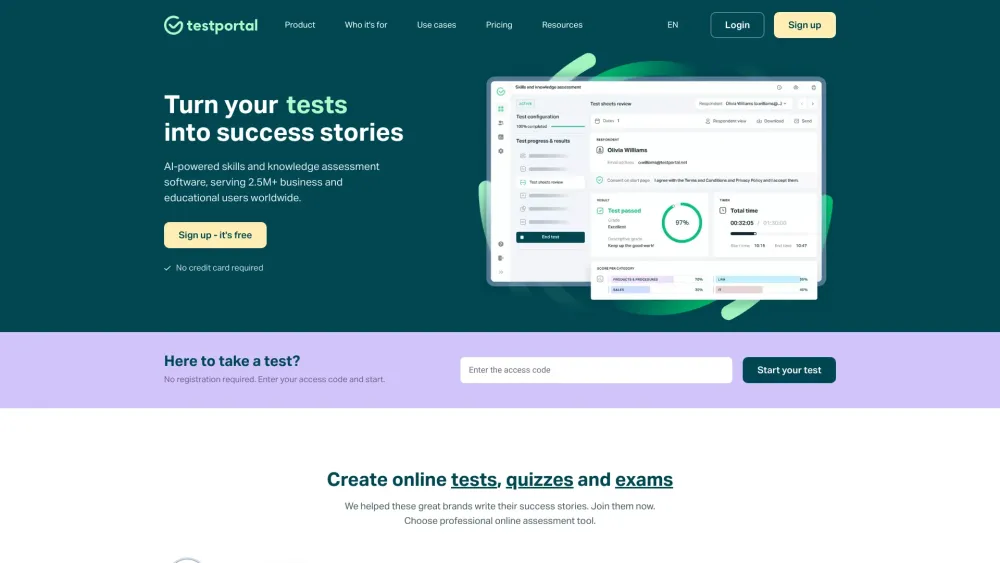

Discover an innovative online assessment platform designed to effortlessly create tests, quizzes, and exams. Enhance your educational experience and streamline evaluation processes with our user-friendly tools tailored for educators and trainers alike.

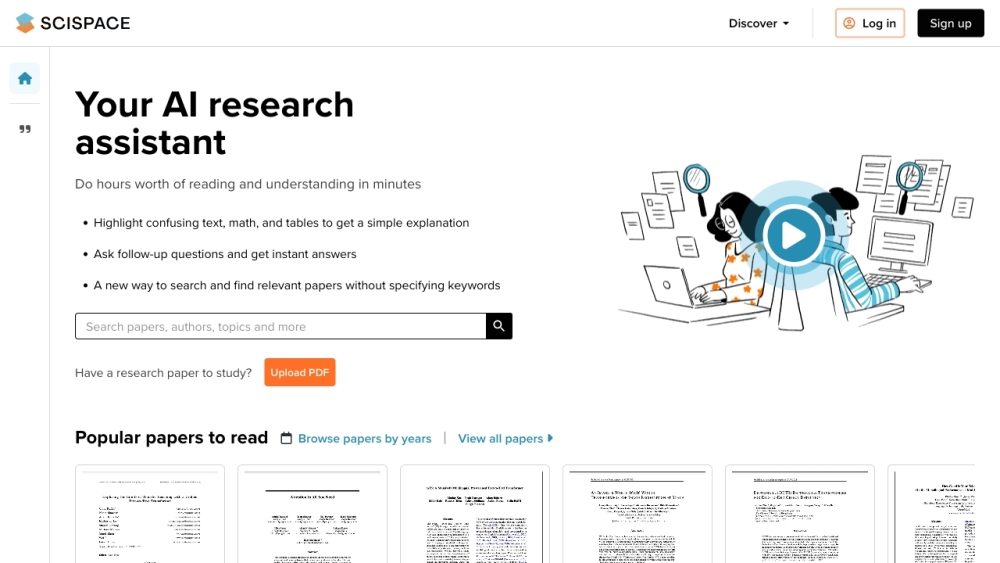

SciSpace is an innovative AI tool designed to help users better understand and evaluate scientific research papers. Whether you’re a student, researcher, or professional, SciSpace transforms complex information into accessible insights, making it easier to navigate the world of academic literature.

Find AI tools in YBX

Related Articles

Refresh Articles