Are Startups Selling Out? The Rise of AI and the Emerging Bubble

Most people like

Welcome to your go-to source for the latest in cryptocurrency news! Stay informed with real-time updates, expert insights, and in-depth analysis of the ever-evolving crypto landscape. Whether you’re a seasoned investor or just starting out, our hub provides valuable information to help you navigate the dynamic world of digital currencies. Keep up with trends, market movements, and technological advancements that shape the future of finance. Dive in and explore the exciting realm of crypto today!

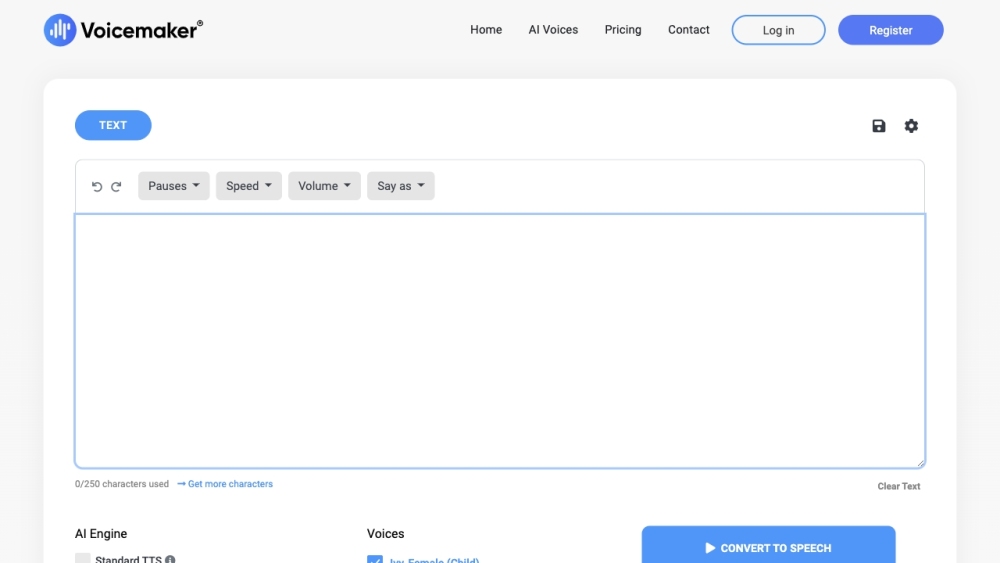

In today's digital landscape, crafting engaging content that resonates with readers is more important than ever. Humanizing AI-generated content not only enhances readability but also fosters a genuine connection with the audience. By incorporating relatable language and a conversational tone, we can transform technical information into accessible narratives. This approach not only captures attention but also encourages deeper understanding, making your content stand out in a sea of information. Embrace the art of humanizing AI content to elevate your writing and engage your readers effectively.

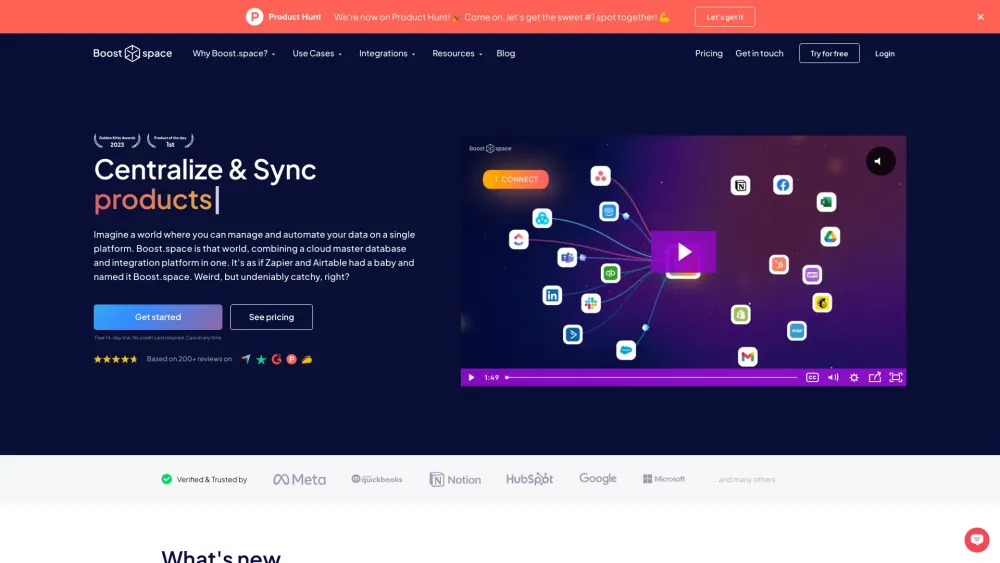

Introducing a powerful no-code tool designed for seamless two-way data synchronization. This innovative solution streamlines your data management process, allowing you to effortlessly synchronize information between multiple platforms without the need for programming skills. Unlock the potential of automated data flow and boost your productivity today!

Find AI tools in YBX

Related Articles

Refresh Articles