Lam Research recently hosted the Lam Capital Venture Competition at its headquarters in Fremont, California. I attended to explore startups within the semiconductor and semiconductor manufacturing equipment sectors.

The event, sponsored by Lam Capital, created a vibrant atmosphere and marked its first in-person gathering since its inception, attracting hundreds of attendees. Notable investors included Weili Dai and her husband Sehat Sutardja, founders of Marvell, along with various corporate VCs that collaborate with Lam. I had the opportunity to interview Audrey Charles, Senior Vice President of Corporate Strategy at Lam Research and head of Lam Capital.

Charles shared that 70 startups applied for the competition, with ten making presentations to a panel of judges. Crystal Sonic was awarded the grand prize of $250,000. Lam Capital has invested in over 20 startups, typically placing investments ranging from $1 million to $10 million. The surge in activity is partly due to the CHIPS and Science Act, which allocates $50 billion in government funding to enhance semiconductor manufacturing in the U.S.

The judging panel included influential figures such as Weili Dai, Rene Do from SK Hynix, Ben Haskell from Lam Capital, and specialists from Cerberus Capital Management, Safar Partners, and TSMC North America.

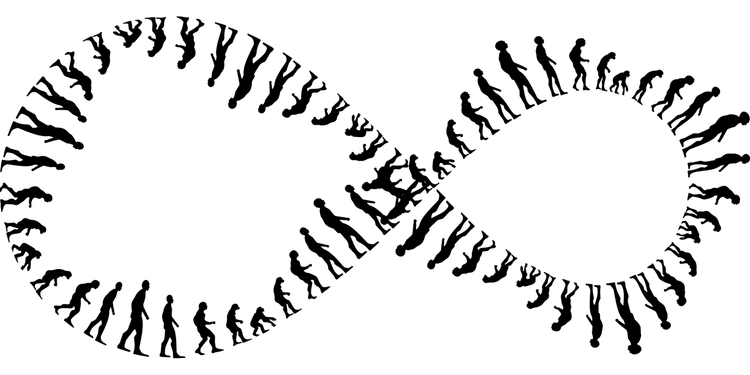

With ongoing investments in the semiconductor ecosystem, we await clarity on whether AI will significantly enhance chip design or if the industry's growth will be constrained by physical limitations, which have slowed Moore’s Law in recent years. While Charles remains optimistic about continued technological advancement, here's a summary of our interview.

Event Overview and Structure

Question: How long have you been hosting this competition, and how do you introduce it to newcomers?

Audrey Charles: This is our third competition, having started in 2019 at MIT, followed by UC Berkeley in 2022. This was our first on-site event aimed at increasing internal participation. We promote it through our Lam Capital website and social media, but most participants come through networking within the venture community.

Question: How many applicants participated this year?

Charles: Over 70 startups applied, a significant increase with high-quality candidates. We narrowed it down to 12 to ensure attendees could participate fully, with ten pitching at the competition.

Question: How many judges were involved?

Charles: There were six judges deciding the winners, including a runner-up, with a top prize of $250,000.

Question: What was the attendance like?

Charles: We had over 250 registrants—around 100 external participants and 150 internal attendees.

Question: Were many attendees external investors interested in the startups?

Charles: Yes, among the diverse crowd were CVCs and representatives from other venture funds. Some startups not selected to pitch also attended to network.

Emerging Trends in Semiconductor Startups

Question: Did you observe any trends in the applicant pool?

Charles: We saw a strong emphasis on AI integration in the pitches, reflecting a major theme this year. The startups focused on areas related to automation, advanced packaging, and enhancing efficiency—all critical for the semiconductor industry.

Investment Insights

Question: How much has Lam invested in startups through Lam Capital?

Charles: We've made more than 20 investments, often at the series A or B stage, typically within the $1-10 million range. Our aim is to invest early when we see a strong value proposition.

Competition Inspiration

Question: What inspired this competition?

Charles: My first experience at the previous competition was incredibly enlightening. It showcased disruptive technologies and fostered connections within the semiconductor community. Participants appreciate the networking opportunities and the exchange of ideas.

Current Economic Climate for Startups

Question: What is the current environment for semiconductor startups?

Charles: There’s a cautiously positive outlook in the semiconductor sector, with increased interest and the establishment of more VC practices focused on the industry. However, challenges remain due to its complexity and capital intensity. Support from initiatives like the CHIPS Act also bolsters the ecosystem's sustainability.

Diversity Among Entrepreneurs

Question: Do you see growing diversity among entrepreneurs?

Charles: While I don't have specific data, the diversity among today’s participants is inspiring. They represent various backgrounds and countries, united by their commitment to advancing semiconductor technologies.

Innovation vs. Moore’s Law

Question: How does the end of Moore’s Law influence startups?

Charles: Rather than presenting barriers, it has created opportunities to explore alternative technologies such as 3D scaling and advanced packaging. There’s a lot of innovation potential in traditional sectors driven by advancements like electric vehicles and smart technologies.

AI's Role in the Semiconductor Industry

Question: Is AI viewed positively within the industry?

Charles: AI is largely seen as an enabler. The complexity of semiconductor processes creates challenges that AI tools can address, enhancing efficiency and development. Combining AI with experienced professionals can yield exceptional results and alleviate workforce shortages.

Impact of the CHIPS Act

Question: Is there increased activity in the U.S. due to the CHIPS Act?

Charles: Yes, over $300 billion is being invested globally, creating significant opportunities for collaboration within the industry. Our event helps us connect with innovative companies and reinforce our role in the semiconductor ecosystem.