As large AI models increasingly integrate into industries, two primary deployment methods for enterprises are emerging:

1. Private Deployment: This model offers heightened security and privacy but requires substantial computational resources, resulting in high operational costs.

2. Public Cloud + API Access: This approach is more cost-effective and flexible. While sectors like finance and healthcare prioritize security and often turn to private deployments, the public cloud + API model is gaining traction across various industries.

This shift is transforming the competitive landscape of the cloud computing industry. At a recent Amazon Web Services (AWS) summit, Ishit Vachhrajani, Global Director of Enterprise Strategy at AWS, emphasized the necessity of cloud services for businesses looking to adopt generative AI. As a result, generative AI, primarily represented by large models, is becoming crucial for cloud providers, prompting more businesses to transition to cloud solutions. Baidu's founder, Li Yanhong, has referred to large models as revolutionary components that will reshape the cloud computing industry.

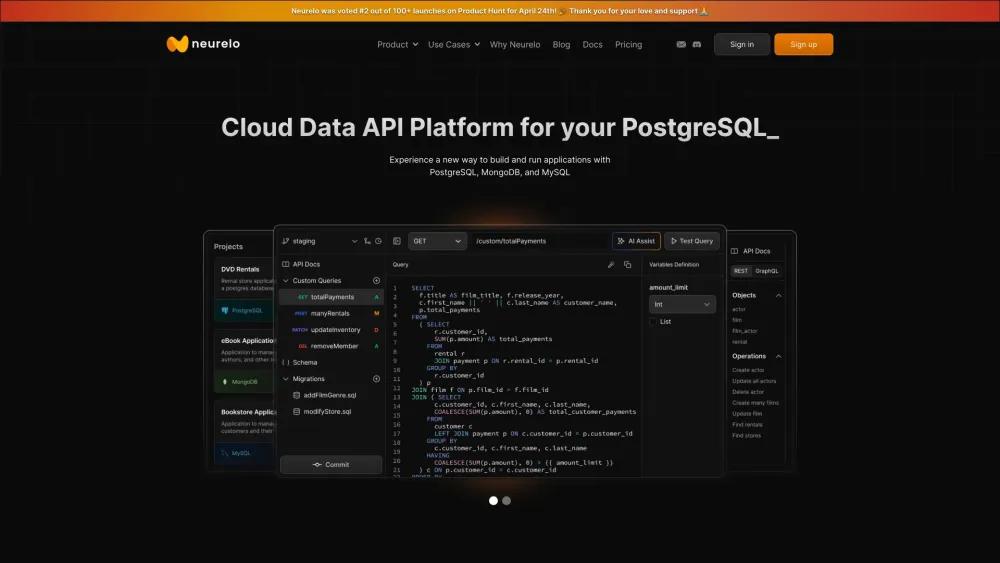

Historically, cloud computing prioritized computational power, speed, and storage. Today, clients are increasingly focused on the quality of frameworks and models, indicating a lucrative shift in the market. Major players like AWS, alongside Chinese companies including Alibaba Cloud, Volcano Engine, and Baidu Smart Cloud, are now offering public cloud + API access services.

To enhance their competitive advantage, cloud providers are committed to creating robust ecosystems for large models. For instance, AWS is incorporating well-known open-source models such as Llama, Mistral, and Stable Diffusion through its Amazon Bedrock service. At the AWS summit, it was announced that foundational models like Baichuan2-7B and Yi-1.5 will also be integrated via SageMaker JumpStart.

Ishit highlighted the importance of selecting the right foundational model for enterprise clients, as API calls allow businesses to evaluate different models quickly. Amazon Bedrock's model evaluation feature facilitates rapid comparisons of multiple large models against testing datasets, aiding businesses in assessing their performance.

On the cost front, cloud providers are working to lower the entry barriers for enterprises using large models, thereby attracting a larger customer base. Recently, notable models like Tongyi Qianwen and Doubao have dramatically reduced their prices, with Baidu offering two model APIs for free. Additionally, Alibaba Cloud has cut overall product prices by an average of over 20%, with some reductions reaching up to 55%.

Liu Weiguang, Senior Vice President of Alibaba Cloud's public cloud division, indicated that the technical benefits and economies of scale offered by public cloud services lead to significant cost and performance advantages. For example, utilizing the Qwen-72B open-source model at a consumption rate of 100 million tokens per month costs approximately 600 yuan on Alibaba Cloud compared to over 10,000 yuan for private deployment. With costs decreasing, a significant increase in API call volumes is anticipated in the near future.

The competitive landscape for large models is also evolving, with deeper collaborations emerging between leading cloud providers and model developers. Major tech companies in China—Alibaba, ByteDance, Tencent, and Baidu—are developing their models, integrating them with their cloud services while allowing for third-party API calls. Globally, AWS has closely aligned with investments in Anthropic, while Microsoft has strengthened its partnership with OpenAI—highlighting large models as vital competitive assets.

China's cloud computing market is undergoing significant restructuring, with a notable trend toward decreasing market concentration in IaaS and PaaS services. IDC reports that the combined market share of the top five companies in the IaaS sector is now 70.8%, a 2% decline year-on-year. In the PaaS sector, the leading players include Alibaba, Tencent, and AWS, which also face a 1.5% drop in market share.

Not only are Chinese internet giants investing heavily in public cloud and large model API integrations, but AWS is also increasing its investment in China. Matt Garman, the incoming global CEO of AWS, highlighted the strategic importance of China for the company. AWS's Greater China President reported steady growth in performance within the region.

A cloud computing professional noted the potential costs involved in switching cloud providers, implying that companies may initially accept lower profits to attract clients. This creates a critical period for competition among cloud providers vying for large model enterprise clients. Ishit mentioned that AWS’s long-term focus on solving customer challenges is key to sustainable profitability, suggesting that success in this approach will lead to financial gain.