OpenAI's $5 Billion Annual Loss: The High Cost of AI Development

Most people like

In today's digital landscape, where data processing power is crucial, GPU rental services have emerged as a game-changing solution for businesses and individuals alike. By tapping into high-performance graphics processing units (GPUs), users can effortlessly scale their computing resources without the hefty upfront costs of purchasing hardware. Whether you're a gamer, a developer, or a data scientist, GPU rental offers flexibility and efficiency tailored to your specific requirements. Explore how GPU services can enhance your projects, accelerate rendering times, and provide the computational power needed to drive innovation.

Introducing a captivating chatbot designed specifically for kids, combining education, entertainment, and inspiration through interactive conversations.

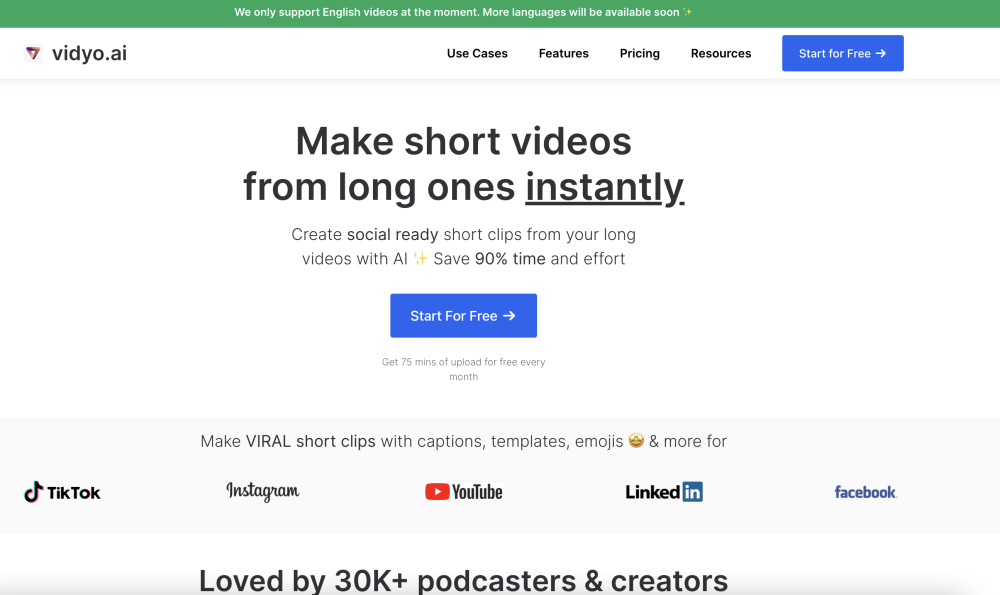

Vidyo.ai transforms podcasts and videos into engaging, shareable clips tailored for social media platforms. Maximize your content's reach and impact by effortlessly creating bite-sized highlights that captivate your audience.

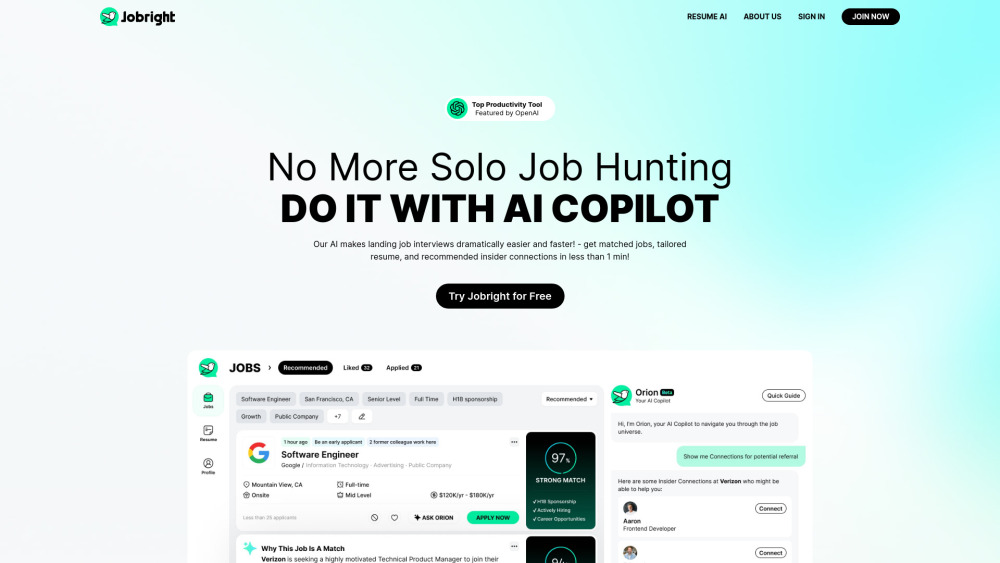

Unlock Your Career Potential with an AI Job Search Copilot for Personalized Job Matches

In today’s competitive job market, finding the right position can be daunting. Enter the AI job search copilot: your intelligent assistant designed to help you navigate the job landscape. By analyzing your skills, preferences, and career goals, this innovative tool provides tailored job recommendations that align perfectly with your aspirations. Save time and streamline your job hunt with personalized suggestions that enhance your chances of landing your dream job.

Find AI tools in YBX