OpenAI's Valuation Could Skyrocket to $90 Billion in the Secondary Market

Most people like

Unlock the power of AI-driven podcast generation, transforming diverse text content into engaging audio experiences. Explore how cutting-edge technology can seamlessly convert articles, blogs, and other written formats into captivating podcasts, making information more accessible and enjoyable.

Hama is a powerful AI tool designed specifically for effortlessly removing unwanted objects and people from your photos. Whether you're enhancing personal memories or creating stunning visuals for projects, Hama streamlines the editing process, making photo retouching simple and effective.

Unlock a wealth of study resources, comprehensive notes, effective test preparation, and expert homework assistance—all available at your fingertips. Enhance your learning experience with knowledgeable tutors ready to support you on your academic journey.

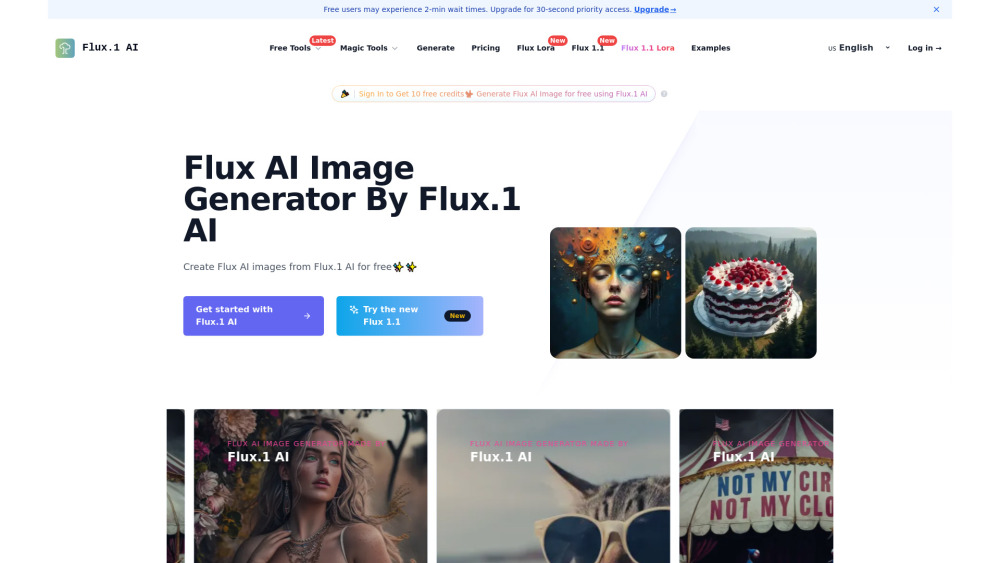

Discover the power of an AI model that transforms text prompts into stunning images. By harnessing advanced algorithms, this innovative tool allows users to visualize their ideas and concepts like never before. Whether you're an artist seeking inspiration or a business looking to enhance your content, our AI-driven image generator opens a world of creative possibilities. Engage your imagination and let technology bring your words to life!

Find AI tools in YBX

Related Articles

Refresh Articles