Renewable Energy Demand Set to Rise Due to AI Data Centres, Despite Trump Administration

Most people like

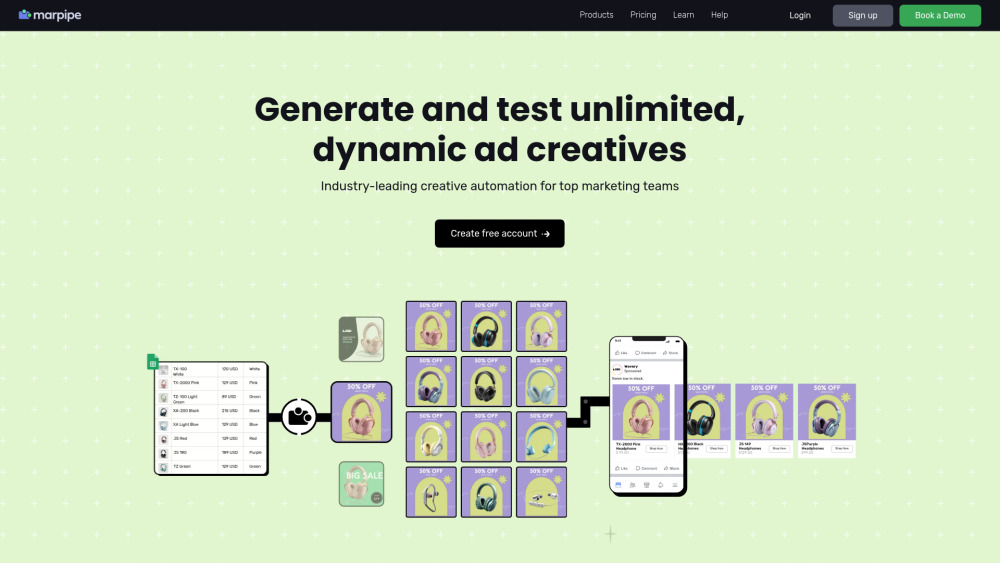

Introducing an automated platform designed for the creation and testing of Dynamic Product Ads. Streamline your advertising efforts and enhance engagement with tailored solutions that optimize your marketing strategy efficiently.

Friday Email.ai is an AI-based automated email tool that helps individuals and teams improve communication efficiency for work progress reports and project updates by automatically generating and optimizing email content.

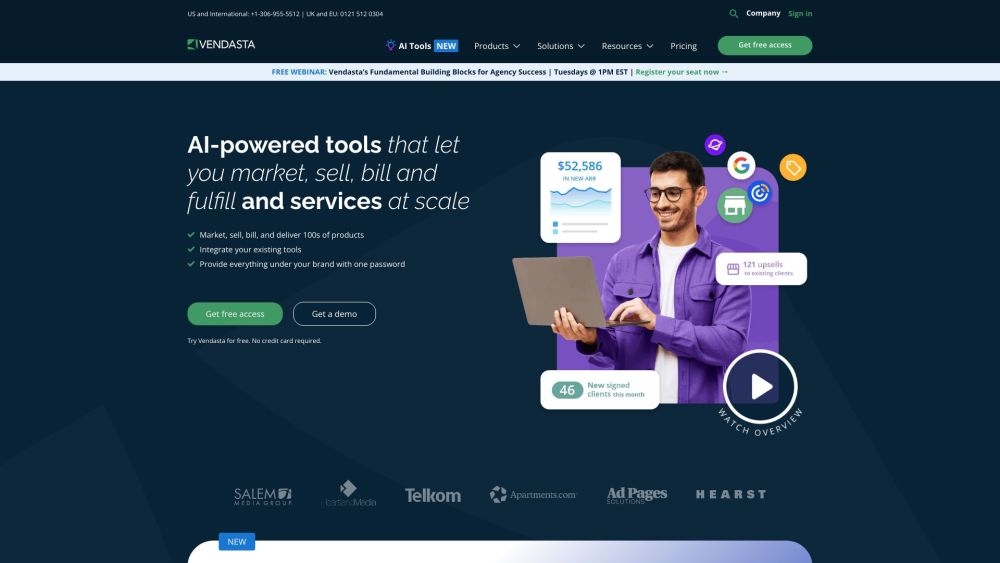

Introducing an AI-driven SaaS platform designed to enhance and scale your digital product sales effectively.

Unlock the power of our innovative AI tool, designed to streamline the analysis of documents and videos with unparalleled efficiency. Enhance your productivity and insights as you seamlessly navigate through vast amounts of content, turning complex data into accessible knowledge effortlessly. Perfect for businesses and researchers alike, this cutting-edge solution revolutionizes the way you interact with information.

Find AI tools in YBX