U.S. Treasury Secretary Yellen: The Implementation of Artificial Intelligence in Finance Could Present Significant Risks

Most people like

In today's competitive job market, standing out in interviews is crucial for landing your dream position. Enter the AI-Powered Interview Copilot—a revolutionary tool designed to enhance your interview skills and boost your confidence. With personalized coaching, real-time feedback, and tailored practice questions, this innovative solution helps job seekers perform at their best. Discover how this technology can transform your interview preparation and pave the way for career success.

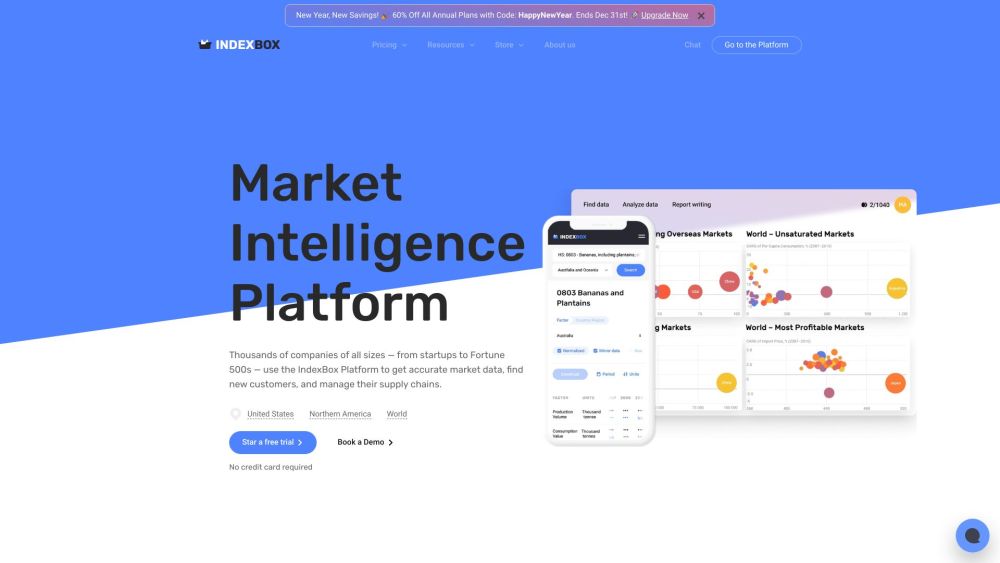

Introducing our AI-driven market intelligence platform, designed to empower businesses with actionable insights and data-driven strategies. This innovative tool harnesses advanced analytics and artificial intelligence to provide a comprehensive understanding of market trends, consumer behavior, and competitive landscapes. Whether you're a seasoned entrepreneur or a growing startup, our platform equips you with the necessary resources to make informed decisions and drive success in today's dynamic marketplace. Experience the future of business intelligence with our cutting-edge solution.

Enhance Your English Vocabulary with Smart Learning Techniques

Unlock the power of effective English vocabulary learning with innovative strategies tailored to boost your language skills. By employing smart techniques, you can expand your vocabulary efficiently and confidently. Discover how to optimize your learning experience while mastering the nuances of the English language.

Find AI tools in YBX