White House Unveils Proposal for $8.5B Funding to Boost Intel's Domestic Chip Manufacturing

Most people like

SolidPoint enables users to save time by transforming lengthy videos into concise, informative summaries. This innovative tool streamlines content consumption, making it easier to grasp key insights quickly.

Discover the ultimate personalized AI music companion designed to enhance your listening experience. This innovative tool tailors music recommendations to your unique tastes, creating a custom soundtrack just for you. With advanced algorithms, it learns from your preferences and provides curated playlists that resonate with your mood, ensuring every note is perfectly suited to your vibe. Embrace the future of music with an AI companion that evolves alongside your musical journey, making every listening session uniquely yours.

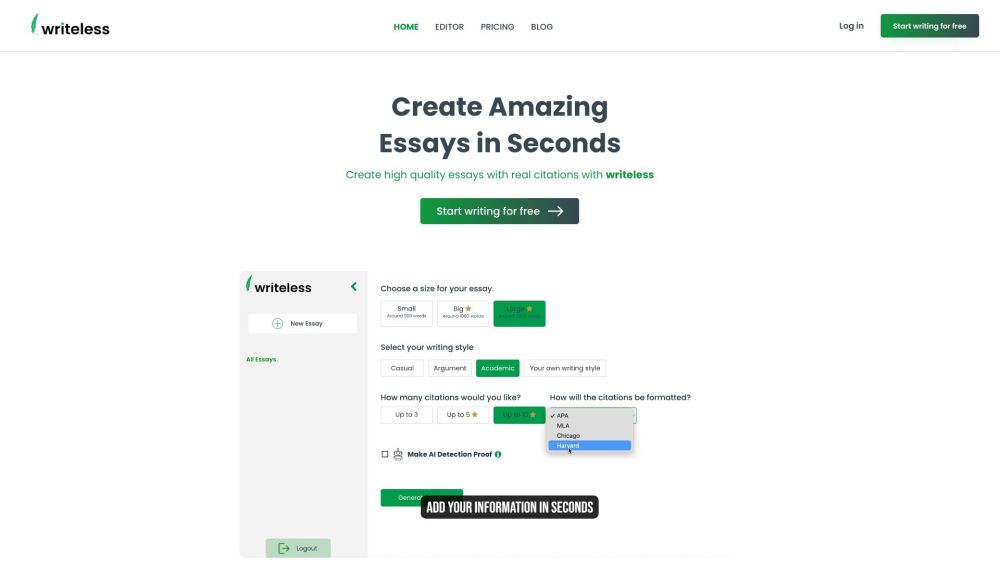

Unlock the power of AI essay writing with authentic citations. Enhance your academic work by utilizing advanced AI tools designed to generate high-quality essays supported by credible sources. Elevate your writing while saving time and ensuring accuracy with reliable citations at your fingertips.

Discover the power of our AI-driven people search engine, designed to connect you with individuals effortlessly. Harnessing cutting-edge artificial intelligence technology, our platform enables users to find and engage with people quickly and effectively. Whether you're looking for old friends, professional contacts, or networking opportunities, our search engine streamlines the process, ensuring you can access the information you need at your fingertips. Experience the future of people searching today!

Find AI tools in YBX

Related Articles

Refresh Articles