In 2019, Jyoti Bansal co-founded Traceable, a San Francisco-based cybersecurity firm, alongside Sanjay Nagaraj. With Traceable, Bansal—who previously co-founded AppDynamics, an app performance management startup acquired by Cisco in 2017—aimed to create a robust platform that safeguards customer APIs against cyberattacks.

Recent trends show a significant uptick in API attacks, which are the essential protocols allowing platforms, apps, and services to communicate. According to cybersecurity firm Check Point, nearly 25% of organizations fell victim to API attacks each week in January 2024, marking a 20% rise compared to the previous year.

API attacks come in various forms, including overwhelming an API with excessive traffic, bypassing authentication protocols, and compromising sensitive data shared through vendor APIs. "There's a critical underestimation of API security," Bansal shared in an interview, "along with a lack of awareness regarding the expanding attack surface of APIs. Many organizations are hesitant to invest in API security due to legacy security solutions that don't effectively address these vulnerabilities."

Bansal highlights that the generative AI boom has led to increased API adoption; however, this growth has also heightened the potential for attacks. A recent study noted that the number of APIs utilized by companies surged more than 200% from July 2022 to July 2023. Additionally, Gartner forecasts that by 2026, over 80% of enterprises will utilize generative AI APIs or implement generative AI-enabled applications.

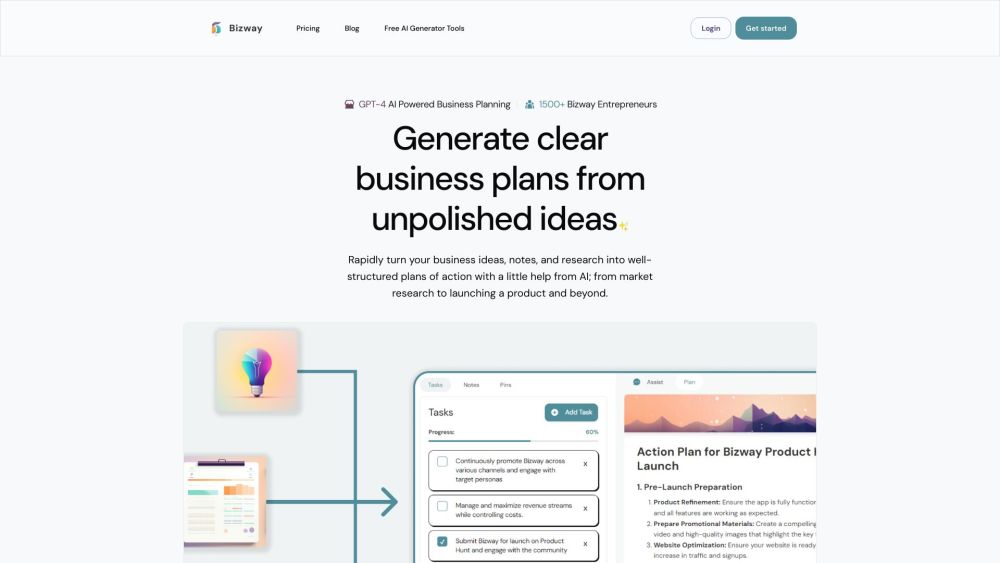

Traceable combats these threats by leveraging AI to analyze API usage data, identifying typical behavior patterns to detect anomalies. The software can discover and catalog both existing and new APIs—including undocumented and "orphaned" (deprecated) ones—in real time, as Bansal explained.

"In order to address modern threat scenarios, we have fine-tuned in-house models using open-source large language models customized with labeled attack data," Bansal elaborated. "Our platform offers tools for API discovery, testing, protection, and threat hunting workflows tailored for IT teams."

The API security market is rapidly growing, with competitors like Noname Security, 42Crunch, Vorlon, Salt Security, Cequence, Ghost Security, Pynt, Akamai, Escape, and F5 all striving for market share. Research and Markets predicts this segment could expand at a compound annual growth rate of 31.5% from 2023 to 2030, driven by increasing cybersecurity threats and a heightened demand for fortified APIs.

Despite market competition, Bansal asserts that Traceable is thriving, currently managing around 500 billion API calls monthly for approximately 50 clients, with expectations to double its revenue this year. While most clients are enterprises, Bansal mentioned that the company is exploring collaborations with government entities.

"Traceable aims to establish a long-term, sustainable business. From a financial standpoint, this means we maintain a healthy margin profile that continues to improve as we grow our revenue," he explained. "We're not focused on profitability right now by choice; instead, we're making strategic, responsible investments aimed at maximizing returns rather than just spending."

In alignment with these goals, Traceable recently secured $30 million in strategic investment from a group of investors, including Citi Ventures (the corporate venture arm of Citigroup), IVP, Geodesic Capital, Sorenson Capital, and Unusual Ventures. This funding values Traceable at $500 million post-money, raising its total funding to $110 million. Bansal confirmed that the new investment will fuel product development, enhance the scaling of Traceable’s platform, and expand its customer engineering teams and partnership programs.

Currently employing around 180 staff members, Bansal anticipates the workforce will grow to 230 by the end of 2024, with a significant portion of the investment allocated to new hires. "We weren’t actively fundraising, as we had ample cash runway before this investment,” Bansal noted, adding that Traceable secured a substantial line of credit along with the new funding. “However, we received considerable demand from investors. The strategic alignment with Citi Ventures and the favorable investment terms encouraged us to pursue this modest investment to expedite our product and market initiatives before contemplating a larger fundraising round."