Nvidia Surpasses Earnings Expectations as Investors Focus on Blackwell AI Chip Demand

Most people like

Revolutionize your online presence with our AI-powered website builder designed specifically for creating high-converting sales funnels.

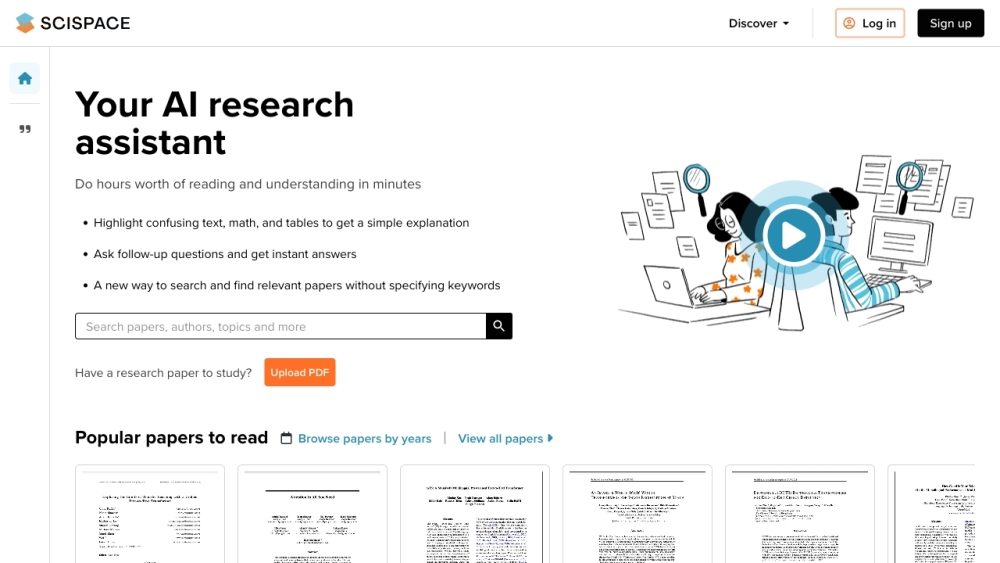

SciSpace is an innovative AI tool designed to help users better understand and evaluate scientific research papers. Whether you’re a student, researcher, or professional, SciSpace transforms complex information into accessible insights, making it easier to navigate the world of academic literature.

Unlock the meanings behind your favorite song lyrics and discover the stories that resonate within the music. Delve into the themes, emotions, and inspirations that give depth to the words, and enhance your appreciation of the artistry involved. With our insights, you can connect on a deeper level with the songs you love. Join us in this journey to explore song lyrics meanings today!

Find AI tools in YBX